A slightly systematized way to identify potential airdrops

This post does not come with a points program

I wasn’t sure about what’s the best place to start looking for protocols that might do a potential airdrop anytime in the coming months and figured its best to try and be systematic about it, if possible.

Rough structure:

Go to DeFillama categories page and identify booming categories

Go under Airdrops on DeFillama and look for protocols under the selected category

Do research on the filtered protocols to see if they have a points program/rumours of an airdrop

That’s mostly it. Let’s test it out.

First, we pull data from here: Categories - DefiLlama

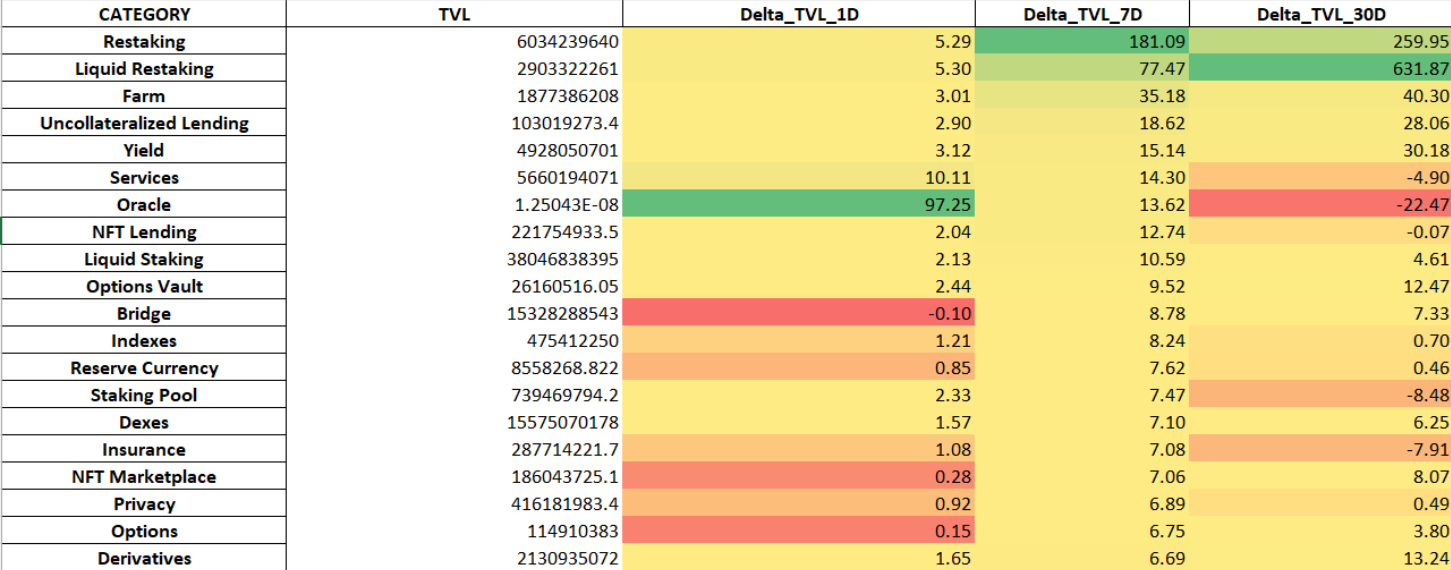

I filtered the data by category and ranked them by tvl changes over the past 7 days (top 20 categories):

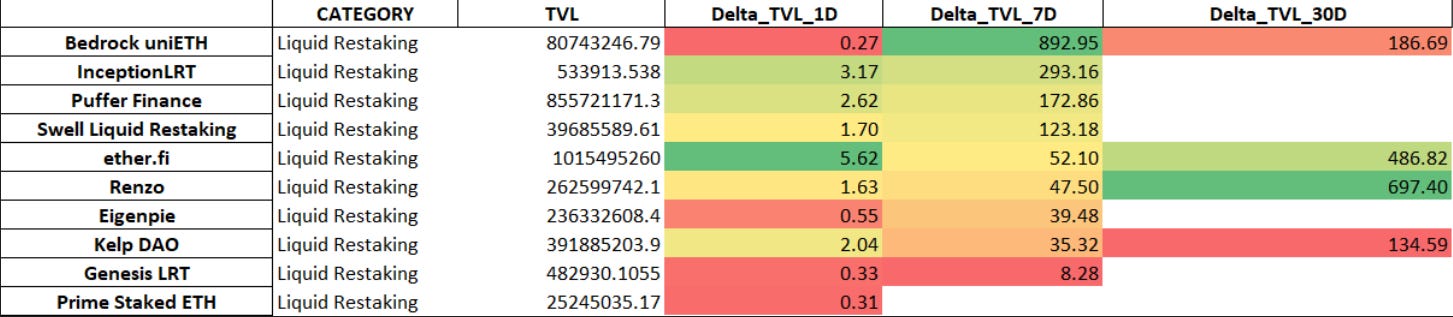

Restaking (Eigenlayer) and liquid restaking are all the hype at the moment. Let’s look into liquid restaking. We do the same thing, pull the data from here: Airdroppable protocols - Defi Llama, then filter for ‘liquid Restaking’ protocols - basically the DeFillama page lists all the protocols that currently don’t have a token.

Ranking the protocols by changes in TVL over the last 7 days, we end up with the following:

Most of these have a points program going on, with additional boost via different mechanisms. For example, Ether.fi - can deposit into pools to boost yield:

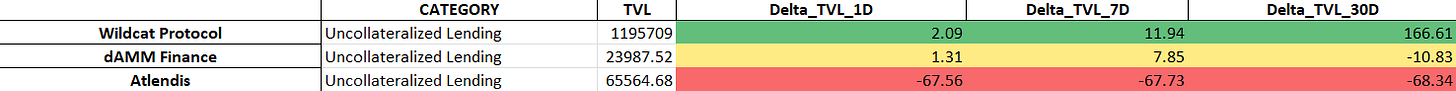

Similarly, I was curious about ‘Uncollateralized Lending’ - going through the same process as above, we end up with the following protocols:

Wildcat Protocol looks interesting but no mention of any potential airdrops - worth checking out though, looks like a cool protocol!

Think it makes sense to get exposure to protocols that are growing under different categories of DeFi. Not sure how much it makes sense to diversify within a sub-category - the value of the airdrop will depend on the size/popularity of the the protocol itself (assuming they actually do an airdrop in the first place).

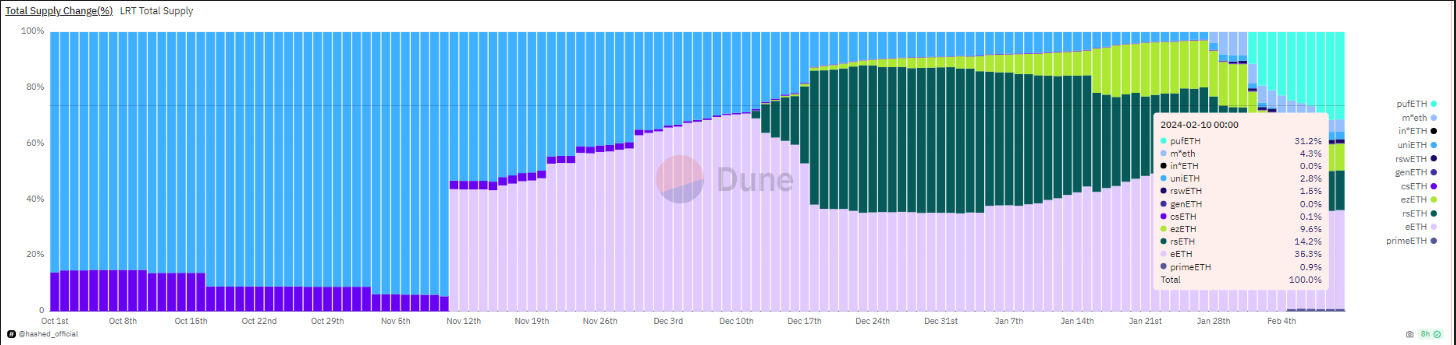

Like for liquid restaking, let’s take a look at the total supply change of different liquid restaking tokens (chart from here):

Puffer Finance (pufETH) and Ether.fi (eETH) currently almost equally dominate the market. In this scenario, does it make sense to have exposure to other protocols within this category? not sure.